Insights

2023 Hart-Scott-Rodino Requirements

Hart-Scott-Rodino (HSR) filing thresholds will be adjusted upward effective February 27, 2023. Effective on the same day, the HSR filing fees will be decreased for relatively small transactions and increased for relatively large transactions.

Parties involved in a merger or acquisition should analyze whether it will exceed the new thresholds. The HSR Act dollar thresholds are adjusted each year. The next set of adjustments will take effect on February 27, 2023. These adjustments may affect whether a company is required to make a premerger notification filing in any given transaction.

What You Need To Do

By way of background, the HSR Act is designed to provide notice to the federal antitrust enforcement agencies (the Federal Trade Commission and the U.S. Department of Justice Antitrust Division) in advance of major mergers and acquisitions. Where the HSR Act applies, the parties to such a transaction must submit a detailed form, along with copies of certain internal documents and consultant documents accompanied by a filing fee. (The filing fees will also change on 2/27/2023, as explained below.) When Congress passed the HSR Act in 1976, Congress set dollar thresholds for its application, and those dollar amounts stayed frozen for 24 years. Congress then reformed the HSR law in 2000 by increasing the thresholds and by providing that they will be adjusted for changes in the U.S. gross national product.

Adjusted Filing Thresholds as of 2023

The dollar figures for this year have been increased, because the nation’s overall economic activity increased. Below is a short reference:

By way of brief review, and after giving effect to the 2023 adjustments to the thresholds, in most instances the parties to a transaction must make an HSR filing if:

- One party has a size of at least $222.7 million (measured by sales or assets);

- the other party has a size of at least $22.3 million (measured by sales or assets if engaged in manufacturing; by assets, usually, if not engaged in manufacturing); and

- the size of the transaction is at least $111.4 million.

Regardless of the size of the parties, an HSR filing will be required if the size of the transaction is at least $445.5 million. These figures will be adjusted for changes in GNP again next year.

Some transactions that would have required an HSR filing last year will not require a filing if they close on or after February 27, 2023. For example, the new size-of-transaction threshold will be $111.4 million. Suppose a given transaction has a size of $105 million. If this transaction closes before February 27, it will require an HSR filing—if the other tests are met—because it is above the current threshold figure of $101 million. If this transaction closes on or after February 27, however, it will not require an HSR filing.

Adjusted Filing Fees as of 2023

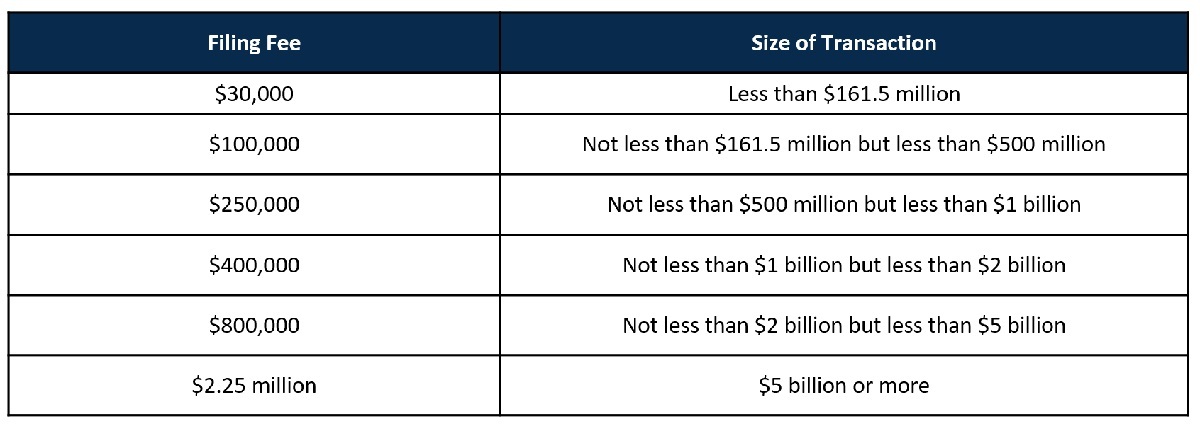

The filing fees for HSR filings are also set to change on the same effective date, February 27, 2023. Currently the fees for an HSR filing are $45,000, $125,000, or $280,000, depending on the size of the transaction. At the end of last year, President Biden signed the Merger Filing Fee Modernization Act into law. Pursuant to the Act, the FTC has promulgated a rule that will increase the filing fees for relatively large transactions while decreasing the fees for relatively small transactions.

For 2023, the filing fees for the adjusted thresholds are as follows:

Changes On The Horizon

The FTC previously announced that it plans to make major changes to the HSR regulations, particularly as they apply to private equity fund families. Under the proposed regulations, in many cases, the HSR “person” may include multiple funds that have the same manager. Once the changes go into effect, it may take more time and effort to prepare an HSR filing for a private equity fund, and some transactions may require an HSR filing that would not have required a filing under the current regulations. The changes have not yet been announced in their final form. We will keep watch for them.

HSR analysis often involves nuances and detailed rules. The parties should consult counsel early in the planning of any transaction that has the potential to cross the HSR filings thresholds.