Insights

2024 Hart-Scott-Rodino Requirements

What You Need to Know

Hart-Scott-Rodino (HSR) filing thresholds will be adjusted upward effective March 6, 2024.

Parties involved in a merger or acquisition should analyze whether it will exceed the new thresholds. The HSR Act dollar thresholds are adjusted each year. The next set of adjustments will take effect on March 6, 2024. These adjustments may affect whether a company is required to make a premerger notification filing in any given transaction.

On December 18, 2023, the Federal Trade Commission (“FTC”) and the U.S. Department of Justice Antitrust Division (“DOJ”) released updated merger guidelines, which describe factors that the FTC and DOJ consider when they review mergers and acquisitions. The updated guidelines do not change the law—the law can only be changed by Congress or the courts—but they show that the FTC and DOJ are raising a wider range of questions in a broader set of transactions. For example, the new guidelines state a presumption that a transaction will be unlawful if it results in a combined firm with more than 30% market share and an increase in market concentration.

Additionally, the FTC is poised to issue new HSR rules, which were officially proposed in the summer of 2023. So far we do not know when the new rules will take effect, but many commentators predict they will be issued in final form before the end of August. The FTC has proposed sweeping changes - click here. These proposals will call for a large amount of additional information and documents in each HSR filing. Once the new rules take effect, parties should expect that a proper HSR filing will require significantly more time and effort.

What You Need to Do

By way of background, the HSR Act is designed to provide notice to the federal antitrust enforcement agencies (the FTC and DOJ) in advance of major mergers and acquisitions. Where the HSR Act applies, the parties to such a transaction must submit a detailed form, along with copies of certain internal documents and consultant documents accompanied by a filing fee. When Congress passed the HSR Act in 1976, Congress set dollar thresholds for its application, and those dollar amounts stayed frozen for 24 years. Congress then reformed the HSR law in 2000 by increasing the thresholds and by providing that they will be adjusted for changes in the U.S. gross national product.

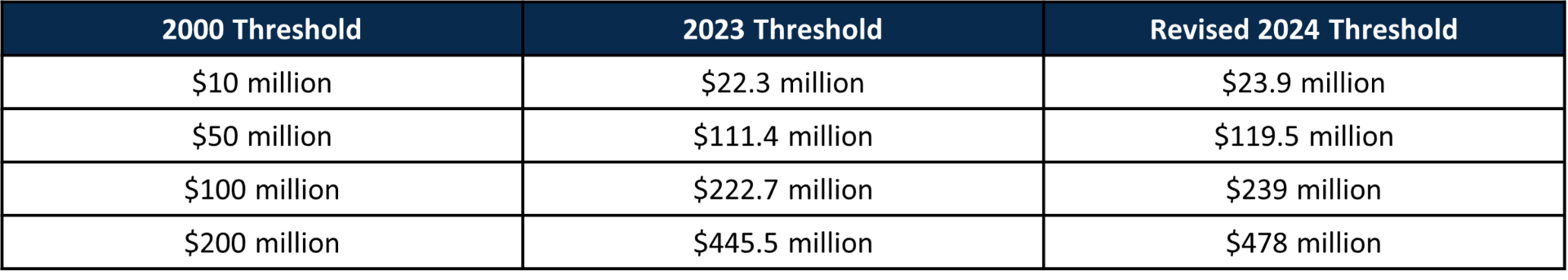

Adjusted Filing Thresholds as of 2024

The dollar figures for this year have been increased because the nation’s overall economic activity increased. Below is a short reference:

By way of brief review, and after giving effect to the 2024 adjustments to the thresholds, in most instances the parties to a transaction must make an HSR filing if:

- One party has a size of at least $239 million (measured by sales or assets);

- The other party has a size of at least $23.9 million (measured by sales or assets if engaged in manufacturing; by assets, usually, if not engaged in manufacturing); and

- The size of the transaction is at least $119.5 million.

Regardless of the size of the parties, an HSR filing will be required if the size of the transaction is at least $478 million. These figures will be adjusted for changes in GNP again next year.

Some transactions that would have required an HSR filing last year will not require a filing if they close on or after March 6, 2024. For example, the new size-of-transaction threshold will be $119.5 million. Suppose a given transaction has a size of $112 million. If this transaction closes before March 6, it will require an HSR filing—if the other tests are met—because it is above the current threshold figure of $111.4 million. If this transaction closes on or after March 6, however, it will not require an HSR filing.

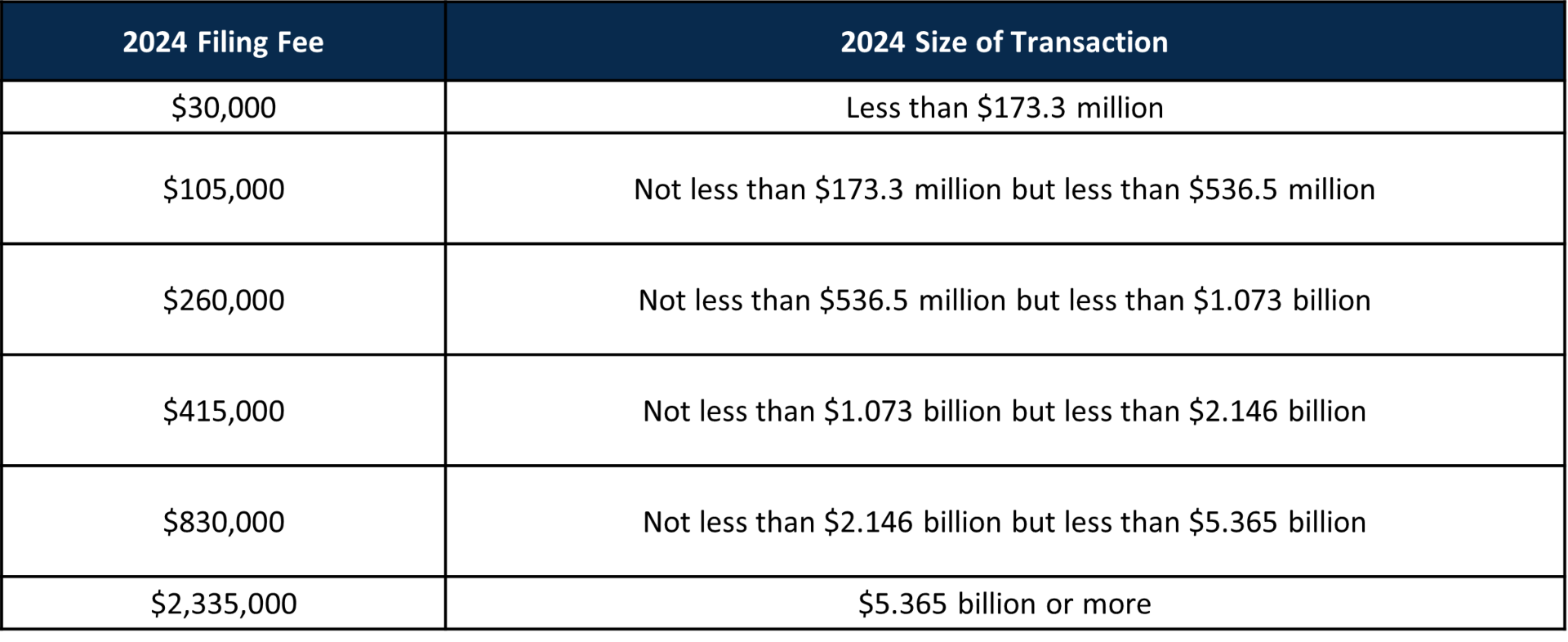

Adjusted Filing Fees as of 2024

The filing fees for HSR filings—and the size of transaction thresholds at which they apply—are also set to change on the same effective date, March 6, 2024. The changes are set out in the following chart.

Plan For Antitrust Analysis Early in The Process

The FTC’s upcoming rule changes are likely to increase substantially the amount of time required to prepare a proper HSR filing. The new HSR rules may require drafts of required documents, information about labor markets—and (in the case of a competitive overlap) customer contact lists, and information on prior acquisitions during the past ten years. It will be important to consult antitrust counsel early in the process for any transaction that has the potential to raise controversy.